Abstract:"As the carbon emission trading market officially launched, China has become the market with the largest carbon emissions in the world. However, the the official carbon emission market is still in the early stages. Therefore, how to better control the development of carbon emission capabilities, and avoid conflict with economic growth seem to be extremly important. As a forerunner, EU probably helps China on this problem with its carbon trading mechanism. "

After 10-years planning and 4-years preparation, the nationwide unified carbon emission trading market was officially launched on July 16, 2021. The market includes 2162 enterprises in the power industry and covers approximately 4.5 billion tons of carbon dioxide emissions, becoming the largest greenhouse gas emissions market globally. Since then, the launch of China's carbon trading market will make considerable contributions to global carbon emissions cooperation. However, the operation of the new market is still in its early stage. Therefore, how to better control the development of carbon emission capabilities, and avoid conflict with economic growth seem to be extremly important. As a forerunner, EU probably helps China on this problem with its carbon trading mechanism.

The History of EU's Carbon Trading Mechanism

Introduction to EU's Carbon Emission Trading Mechanism

The European Union Emissions Trading Systems (“EU-ETS”) was established in 2005. It is thefirst carbon trading market in the world, and it is also a relatively mature carbon trading market. The concept relies on the "invisble hands of the market" - to reduce greenhouse gas emissions by enabling buy and sell carbon dioxide emission rights as commodities. Companies that successfully reduce emissions can sell excess "emission allowance", while companies that emit excess emissions must purchase the allowance on the carbon emission market. ETS operates according to the principle of "Cap and Trade", and meanwhile the government will set a time-sensitive-diminishing upper limit on the total amount of greenhouse gases emitted by the enterprises or equipment covered by the system. Goal of reducing total emissions will be achieved in this way.

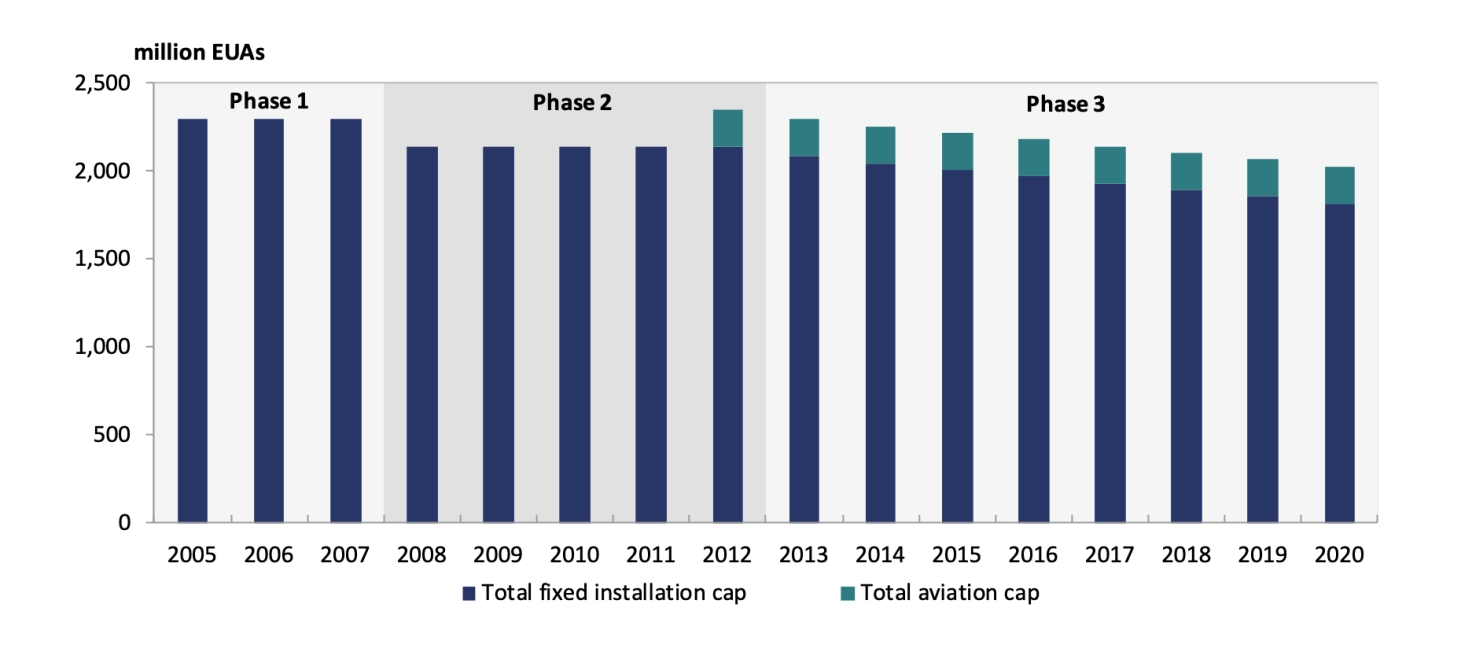

Figure 1:EU-ETS Emission Upper Limit in Stage III Source:EU-ETS Handbook, 2015

The Development of EU's Carbon Emission Trading Mechanism

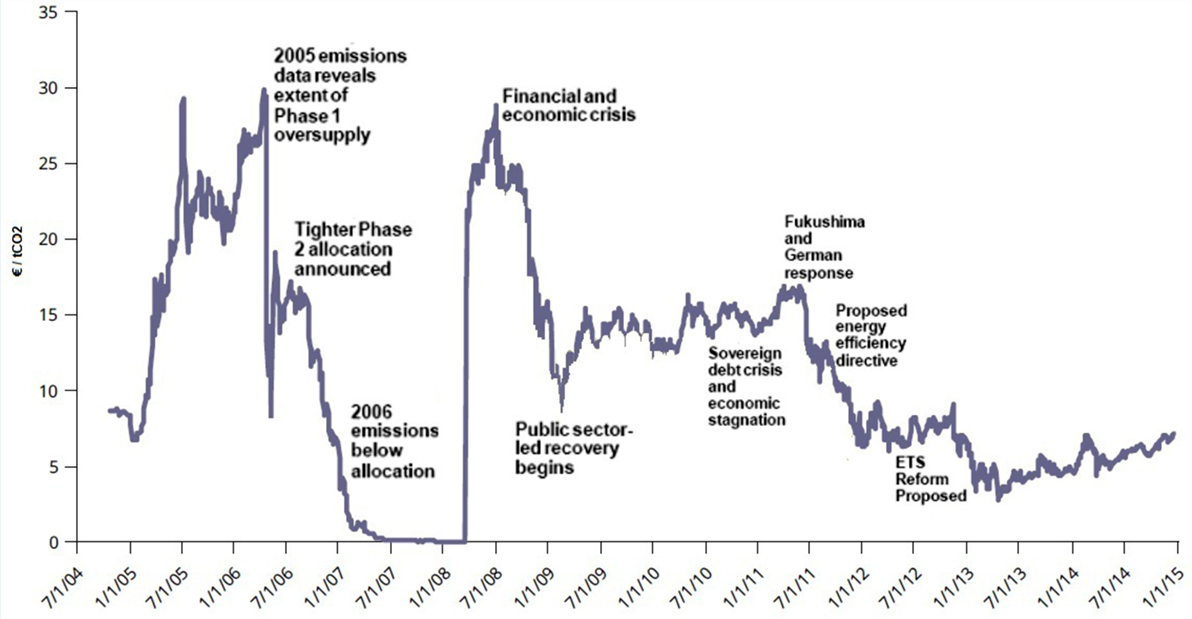

In the 1990s, in response to climate change, the European Union began to focus on energy conservation and emission reduction, and ETS was born. According to the EU-ETS Handbook, ETS has gone through four stages of operation so far: ➢ From 2005 to 2007, the first phase was described as "learning by doing" pilot program, which provided the necessary infrastructure for monitoring, reporting and verifying the emissions of the companies covered. Due to lack of data, the emission allowance in the first phase could only be determined on the basis of estimates. As a result, the total amount of emission allowance issued exceeded the total emissions, so the price of carbon emissions right fell to 0 euros. ➢ From 2008 to 2012, although the ETS adjusted the emission allowance issued in the second phase, due to the reduction in emissions caused by the global financial crisis in 2008, the demand still ran behind the supply of emssion allowance, and the price of carbon emissions right continued to fall consequently. ➢ The third stage is from 2013 to 2020. The European Commission has stricter restrictions on quotas, and gradually shifted from free quotas to auctions, and enlarged the range to cover power, aviation, and traditional industry, but the actual price is still low (Figure 2). ➢ In April 2018, the EU set the EU-ETS fourth phase target and revised the emission allowance distribution method: by 2030, the covered industries will be required to reduce emissions by 43% on the basis of 2005.

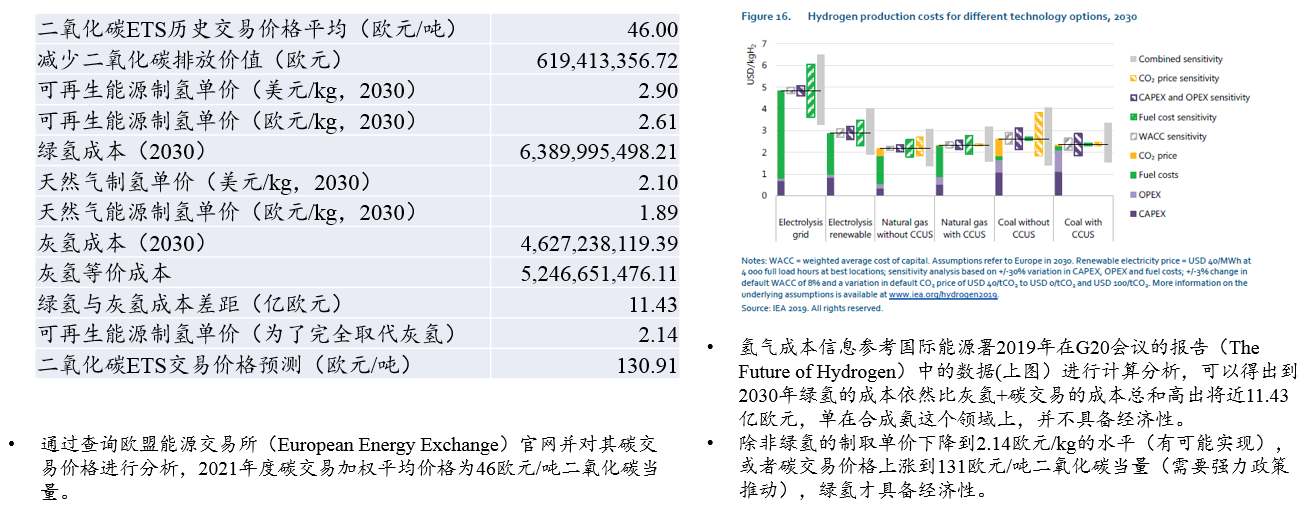

Yield Capital team has studied its rules in depth. Based on the calculations conducted on the synthetic ammonia and steel industries, it shows that: ➢ First, the prices of renewable energy, fossil energy, and carbon emission synthetically determine when the eco-friendly replacement of fossil energy by renewable energy is economical; ➢ Second, the decarbonization of industrial sectors (such as synthetic ammonia) by only raising transaction prices through ETS may simultaneously push up the costs of all sectors (assuming that the CO2 price reaches 131 euros/ton), so low-carbon renewable energy costs must be reduced simultaneously (Figure 3).

Figure 2: EUA Price Change and Key Issues During 2005-2015, Source: Simone and Montini, 2016

Figure 3: The Impact of ETS Rules on Synthetic Ammonia during 2021-2030, Source: Yield Capital

The Goal of EU's Carbon Emission Trading Mechanism

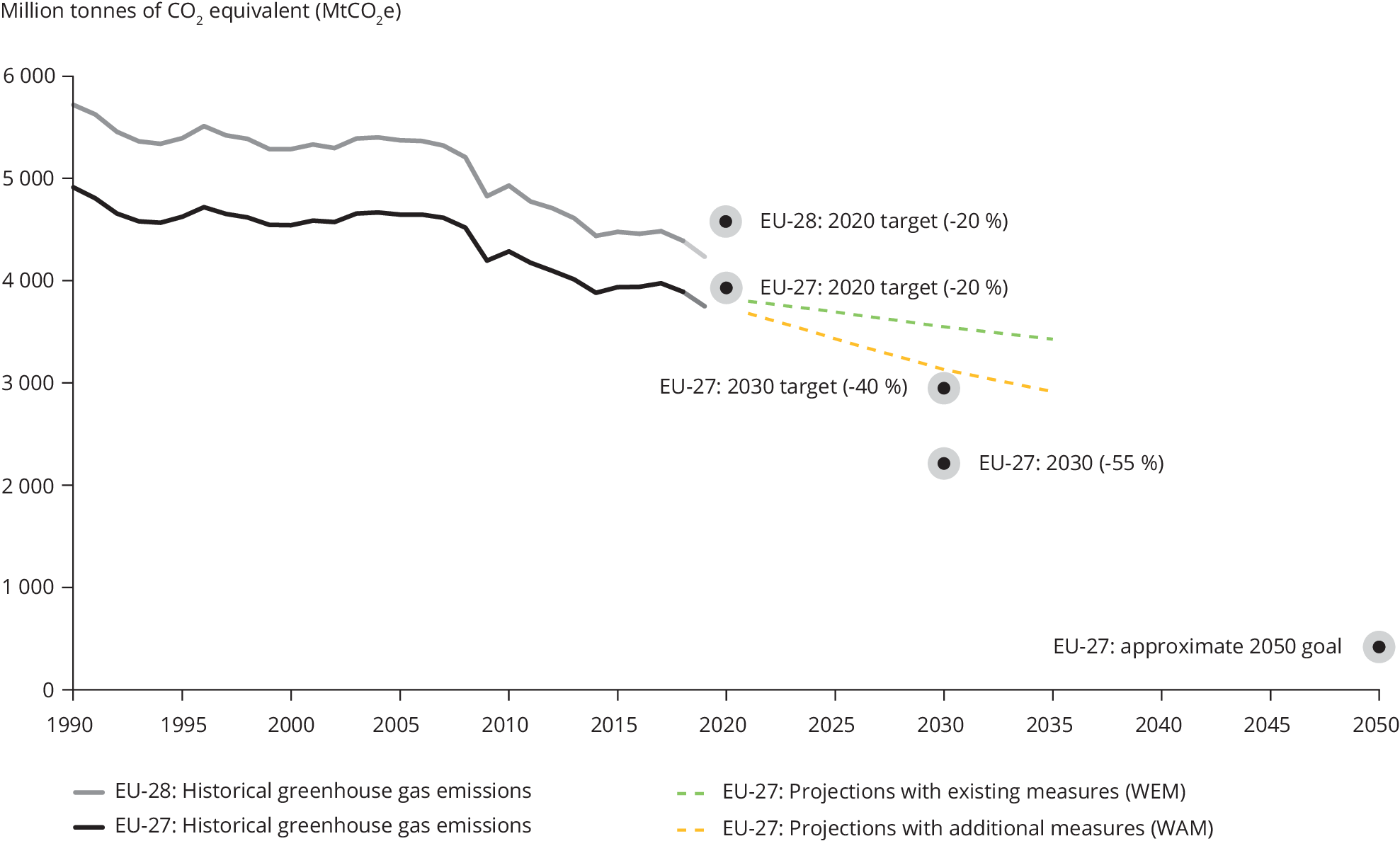

The primary goal is to effectively reduce greenhouse gas emissions. Restrict greenhouse gas emissions through the absolute upper limit set by the government. ICAP (International Carbon Action Partnership) believes that as long as the ETS legislation is sound and long-term stable, ETS can achieve emission reduction targets with a high certainty. Under the EU climate & energy framework, compared with the 1990 peak (5.574 billion tons of carbon dioxide equivalent, including 809 million tons in the UK that year), the new law in 2030 stipulates that EU27 must reduce greenhouse gas emissions by 55% at least.(Figure 4).

Figure 4: EU Greenhouse Gas Emission Targets and Trends, Source: EEA

Note: -40% is the previous target, -55% is the new target stipulated by the new EU Act

The second is to promote low-carbon investment. EU-ETS aims to promote low-carbon investment. Releasing a carbon price signal will be very helpful for ETS to promote the innovation of low-carbon production, low-carbon products and low-carbon technology. New renewable energy sources (such as onshore wind power and biomass energy) are the keys of low-carbon investment. The EU can promote the development of renewable energy by controlling the price of carbon emissions to attract investment in these renewable energy programs.

The Performance of EU's Carbon Emission Trading Mechanism

EU's Carbon Emission Trading Mechanism performed well on reduction of greenhouse gas emission. Although there are many factors that affect emissions, research on the currently operating ETS shows that the emission reduction performance is excellent. From 2005 to 2015, the emissions of the sectors covered by EU-ETS were reduced by 24%, while in 2019, all other sectors only achieved 24% equivalent emission reductions. During 2008 - 2016, more than 1 billion tons of carbon dioxide was reduced.

EU's Carbon Emission Trading Mechanism performed well economicallyETS is considered to be the most cost efficient way to achieve the emission reduction goal by using the "invisible hands of the market". The published pearl research found that ETS produced the lowest cost per ton. In 2013, among the OECD countries, the cost of one ton reduction of CO2 emission for power sector was $40 by using traditional method, while less than $10 by using ETS. In addition, the European Commission also provides a long-term stable policy environment for clean investment and clean technology. Jaraite and Maria conducted research on some European companies from 2003 to 2010 and found that the companies that participated in the ETS successfully reduced parts of ineffective assets.

Challenges in EU's Carbon Emission Trading Mechanism

The risk of failure of the carbon emission trading market. During the first phase of implementation of EU-ETS, many problems have arisen in terms of trading quotas. Due to lack of reliable emission data, the emission limit is mainly estimated based on historical data which is not precise. As a result, the total emission allowance was over-allocated, which led to dramatic price fluctuations in the market, and prices were even lowered to zero (Figure 2). The violent price fluctuations slowed down the low-carbon investment from the companies in the EU-ETS, some of which believe that investment in low-carbon technologies will be postponed in the absence of stable market price signals.

Problems caused by carbon leakage. Carbon leakage refers to the fact that due to climate policies that increase production costs, companies may transfer manufacturing to the countries with lower emission constraints. In this way, the total emissions increase instead, which not only reduces local investment and employment, but also makes carbon emissions unable to be effectively controlled. In the first two phases of practice, it was found that the carbon leakage problem has affected the effect of climate policy. The European Union currently stipulates that industries with carbon leakage risks will get a larger emission allowance. In theory, industries and sectors facing significant carbon leakage risks can still have 100% free quotas.

The Current Situation in China Emission Trading Market

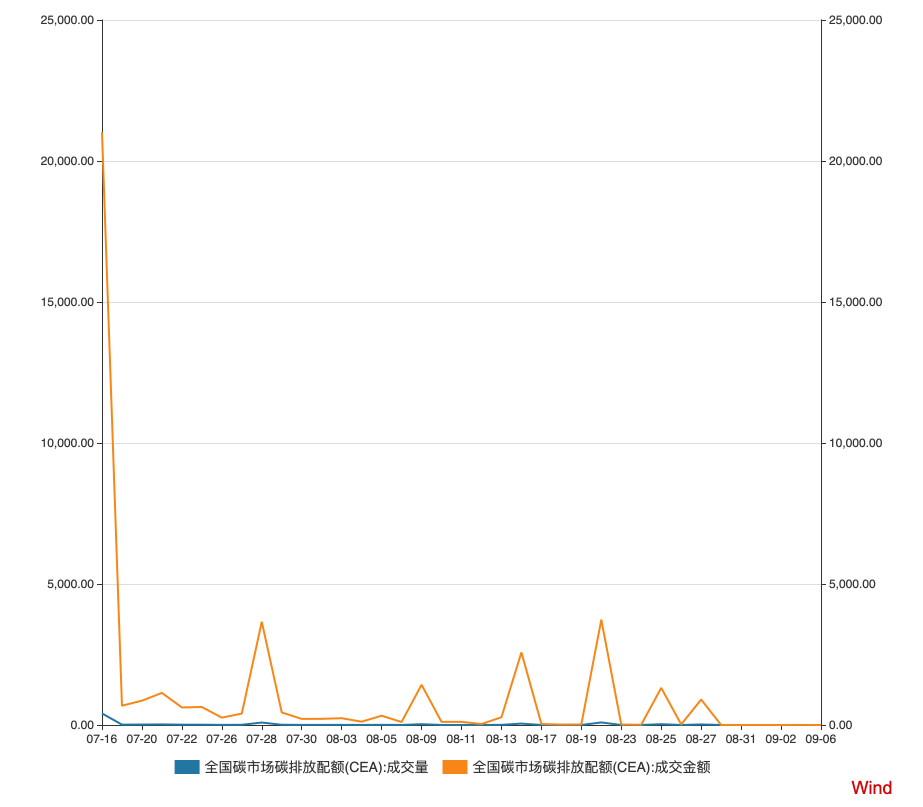

In July, the National Unified Carbon Emissions Trading Market (CEA) was just launched. From the observation in the past two months, the market was not active. Since the highest trading volume (4,104,400 tons and 21,230,500 yuan) on the first day, the market performance has been relatively flat - the highest trading volume was 908,000 tons, while the lowest trading volume was only 10 tons. The main carbon emission allowance transactions were basically made by the national key power and energy enterprise, and the effect of the market on reducing carbon emissions remains to be seen.

Trading volume and turnover rate in the first month were not active

Although the trading volume on the first day was higher than expected, and industry insiders were generally encouraged, the trading volume on the first day mainly came from companies rushing to the door. Starting from the second trading day, although the trading price rose slightly, the trading volume fell more severely from previous day, and the liquidity was slightly insufficient (Figure 5). One major reason is that the current free emission allowance may cause oversupply. Since the market opened in mid-July, the transaction volume and transaction value have been declining, and the transaction volume was only 10 tons at the lowest point. If the situation is not changed, it may repeat the mistakes of EU-ETS practice, leading to the market failure.

Figure 5: National Carbon Market Emission Allowance (CEA) Transaction Volume: July to Present, Source: Wind

At this stage, the main players in the market are not diversified, and the financial attributes are limited.

Most of the main players in China's carbon emission trading market are power and energy companies, while financial institutions and individual investors do not directly participate in the carbon trading market. This phenomenon creates the difficualties in expansion of funds because individual investors or financial institutions probably think they are unprofitable in this market. Moreover, the market lacks of financial derivatives, such as options and futures, which leads to risk hedging problems. Zhongquan Miao from China Power believes that China's carbon emission trading market is in its infancy and its financial attributes are strictly limited. The reasons why it lacks of financial institution investors are: first, there are so many unknown factors in various aspects, and participants need to be screened during the test stage; second, in this market, China government currently only allows spot transactions, while the European and American allow option/forward/future tradings; third, pricing system is more limited - China's goal is to reduce carbon emissions by every single unit, rather than the total reduction.

The market has not covered high-emission industries such as steel, petrochemical and chemical industries yet.

From the practice of EU-ETS, it can be found that the carbon trading market is an cost efficient emission reduction tool, and more industrial enterprises should be included in the market. The companies participating in the operation now only include more than 2,000 power companies, which means that about 40% of the large-scale enterprises with higher energy consumption and higher carbon emissions, such as petroleum refining, petrochemical chemicals, non-ferrous metal smelting and other industries are not yet included. In addition, China Power pointed out that industries with relatively single, high-carbon emissions products such as steel and cement have not even specified a schedule for participating in the carbon market yet. From a national perspective, the guidance ability of the overall carbon trading market will also be limited if only parts of the sectors are covered.

Enlightenment from EU Carbon Emission Trading Mechanism

Ensure intensity control, mandatory emission reduction and industry expansion

The smooth operation of EU-ETS shows that a total amount control, mandatory emission reduction and a unified trading mechanism are the keys to a excellent carbon emission market. China's current quotas follow the principle of intensity control, but it is slightly different from EU-ETS, that is - China controls carbon dioxide emissions per unit of GDP, rather than absolute total control. But it is also necessary to determine the total amount of carbon allowances to meet the basic condition of carbon emission trading. In the future, China has to formulate detailed, operable and supervisable policies to ensure the stable development of the market. In addition, in order to ensure that the goal of reducing total emissions is achieved, China need to allocate the emission allowance at a rational price rather than free. Finally, learn from the three stages of EU-ETS, and gradually cover energy-intensive industries such as power generation, petrochemical, chemical, steel, as well as civil aviation and other transportation industries.

The liquidity of China's Carbon Emission Trading Mechanism needs to be improved

No matter for China or the EU, the lack of liquidity causes prices to continue to fall. The practice of the first phase of EU-ETS has shown that insufficient liquidity caused by oversupply will make the carbon emission trading market ineffective. This problem also exists in China. From July to September, the transaction volume gradually declined, from a few hundred thousand transactions to a few thousand to only a few dozen recently. Therefore, China should learn from the EU about the ETS development experience, that is - gradually tighten the free quota, and inject liquidity into the market to ensure the smooth operation of the market. The government needs to consider introducing financial institution investors and large funds to stimulate the market, bring liquidity into the market, and ensure the active and stable operation of the market. At the "Carbon Neutrality Summit Forum", Vice President Shi Yichen stated that the current carbon emission price in China still has a lot of room for growth. In the future, as the price of carbon assets gradually rises, its price transmission and discovery mechanism will be more helpful to promote the transformation and upgrading of the industry.

Need the strong macro-control to ensure the stability of the carbon emission market

The experience from the ETS has shown that the outbreak of the financial crisis has led to a downturn in carbon trading market prices and reduced investment in low-carbon technologies. It is not difficult to find that the operation of the carbon market must inevitably respond to the macro economy changes - The fluctuating carbon price with the economic cycle does do damage to the emission reduction efficiency of the carbon emission trading mechanism, and consequently the investment incentives for low-carbon economic transformation will be weakened. Therefore, the design of China's carbon emission trading mechanism exerts strong macro-control to ensure price stability. However, strong macro-control should only be used as a supplementary method, and the "invisible hands of market" should be the primary theory to establish an carbon trading market that matches characteristics of the market economy with socialism attributes.

Postscript

The launch of a China carbon emission trading market is a nationwide action that matches China's plan to implement international emission reduction responsibilities over the past 10 years. Yingmin Zhao, the deputy minister of the Ministry of Ecology and Environment, said that the national carbon emission market is extremely important for carbon peaking and carbon neutrality. It is mainly shown in several aspects: the first one is to promote high-emission industries controlled by the carbon market to achieve green and low-carbon industrial structure and energy consumption, and to promote high-emission industries to reach the peak first; the 2nd one is to release carbon emission reduction price signals, provide economic incentives, and guide funds inject capital to industrial enterprises with high emission reduction potential to promote green and low-carbon technological innovation; third, by building a national carbon market offset mechanism, promote forestry carbon sinks, the development of renewable energy, and advocate green and low-carbon production and consumption; fourth, Relying on the national carbon market, it provides investment and financing channels for the transformation of green and low-carbon development in industries and regions, and achieves carbon peak and carbon neutrality. Dewen Mei, the general manager of Beijing Central Exchange, believes that looking forward to the future, the carbon emission market provides incentives and restraint mechanisms for carbon neutrality. The scale, liquidity, and price of China's future carbon trading market, under the assumption of the impossible triangle theory will tend to be globalized. "Exotic stone carves a native gems." Since China's carbon emission trading market is still in its infancy, by learning from the valuable experience of the international carbon market, we can accelerate the realization of the "30/60" dual carbon goal and build the whole human beings a community with a shared future.